Millions of families up and down the country are facing an imminent 'Christmas nightmare' as mortgage rates are set to soar – with the potential of losing their homes in the festive period.

Liberal Democrat leader Sir Ed Davey has urged the government to take immediate action to protect those on the brink of repossession, while also calling for a ban on banks repossessing homes during the holidays.

Sir Ed's party have proposed a temporary ban on home repossession until the end of the year, similar to the ban which was enacted during the pandemic.

He also insists on the creation of a Mortgage Protection Fund, to provide temporary grants to those most at risk of repossession.

"The Conservative government put hundreds of pounds on people's mortgages through their disastrous mini-budget. The very least they could now do is take responsibility for fixing this mess and protecting homeowners on the brink," said Sir Ed.

"No-one should face losing their home this Christmas because the Conservative government crashed the economy."

The government said it had met with lenders to ensure they support mortgage holders in financial difficulty.

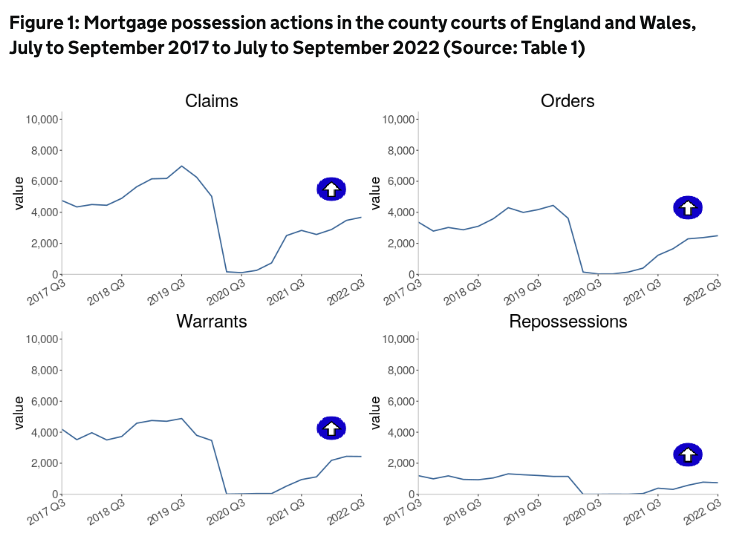

Sadly, this may not be enough to save thousands of households from repossession. The latest figures from the government show mortgage possession claims in the courts increased by 30%, from July to September this year – although they are still lower than before the pandemic.

Rates on new fixed-rate mortgages deals have also climbed throughout this year, following the Bank of England's decision to raise interest rates.

Then-Chancellor Kwasi Kwarteng's mini-budget in September saw these already high rates skyrocket, and although they fell back slightly following Jeremy Hunt's Autumn Statement, anyone taking out a new mortgage is likely to pay a much higher rate than their previous deal.

Under the Lib Dems' proposals, anyone whose mortgage payments increase by more than 10% of their household income would get a grant to cover the cost of that rise for the next year, up to a maximum of £300 a month.

The party is also calling for an increase in housing benefit and for the government to pass much-delayed legislation to ban Section 21 no-fault evictions, where private landlords can evict tenants without giving a reason.

Sir Ed has urged the government to pass legislation before the Christmas recess to enact the ban on no-fault evictions, in an effort to prevent thousands of families from the distress of being evicted during the festive period.

A government spokesman said: "We are protecting vulnerable families from homelessness this winter with an extra £50m to prevent evictions and secure new places for people to live."

They are also providing cost-of-living payments to the most vulnerable households, in addition to support with energy bills.

It's clear that more needs to be done to protect homeowners from repossession this Christmas. With rates on the rise and no sign of the economy bouncing back, it's essential that the government takes proactive steps to ensure those already struggling don't suffer the devastating consequences of losing their home.

If you feel passionately about this like we do, and want to support Sir Ed, please write to your MP. Landlords play a crucial role in creating and maintaining housing in our country. The cost of living crisis has impacted so many and we need a sustainable path forwards which supports landlords but protects tenants who are beng hit hard through no fault of their own.